Title: Predicting the IPO Price of Stripe: A Comprehensive Analysis

Introduction

The initial public offering (IPO) of a company is one of the most anticipated events in the financial world. It marks the transition from a private to a public entity, offering investors a chance to own a piece of a promising business. One such company that has generated considerable buzz in the financial community is Stripe, a leading global payments platform. With its IPO on the horizon, investors and analysts are eager to predict the IPO price of Stripe. This article aims to provide a comprehensive analysis of the factors that could influence the IPO price of Stripe and offer insights into the potential valuation.

Understanding Stripe

Before diving into the prediction of Stripe’s IPO price, it is essential to understand the company’s business model and growth trajectory. Stripe is a financial technology company that provides various payment services to businesses of all sizes. Its platform allows companies to accept payments online, in-app, and in-store, making it a one-stop solution for payment processing. Stripe’s success can be attributed to its focus on simplicity, security, and scalability, which has enabled it to capture a significant market share in the global payments industry.

Market Conditions and Economic Factors

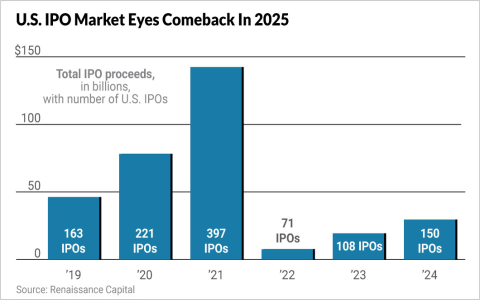

One of the primary factors that can influence the IPO price of Stripe is the overall market conditions and economic factors. The stock market’s performance, interest rates, and inflation rates can all play a crucial role in determining the valuation of a company. For instance, during periods of economic growth and low interest rates, investors are more willing to pay higher prices for stocks, leading to a potential increase in the IPO price of Stripe.

Moreover, the current market sentiment towards technology companies can also impact the IPO price. With the rise of fintech and the increasing importance of digital payments, investors may be more inclined to invest in companies like Stripe, driving up the IPO price.

Comparative Analysis with Similar Companies

To predict the IPO price of Stripe, it is helpful to look at the valuations of similar companies that have gone public recently. Companies like PayPal, Square, and Visa offer valuable insights into the potential valuation of Stripe. By analyzing the IPO prices of these companies and their subsequent market performance, we can gain a better understanding of the factors that influence the valuation of payment processing companies.

For instance, PayPal’s IPO in 2015 was priced at $25 per share, and it has since appreciated significantly. Square’s IPO in 2015 was priced at $9 per share, and it has also seen substantial growth. By comparing these valuations with Stripe’s growth rate and market potential, we can make an educated guess about the potential IPO price of Stripe.

Stripe’s Financial Performance

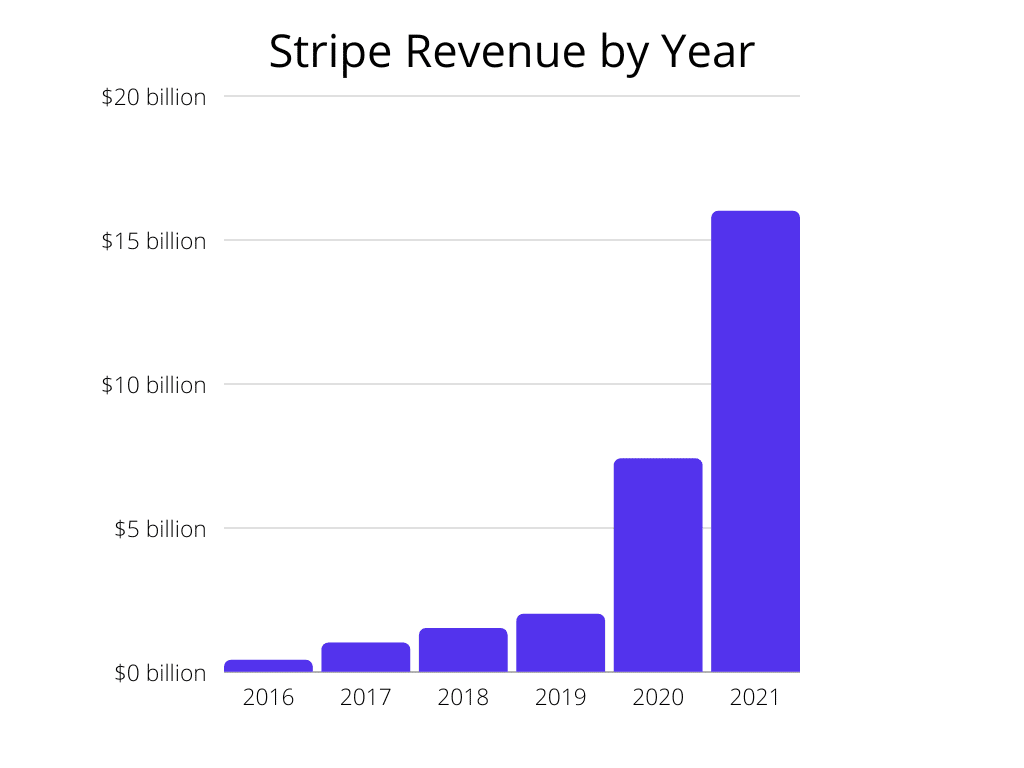

Another crucial factor in predicting the IPO price of Stripe is its financial performance. Analyzing the company’s revenue growth, profitability, and cash flow can provide valuable insights into its valuation. Stripe has been experiencing rapid growth, with its revenue increasing at a compounded annual growth rate (CAGR) of 40% over the past few years. Its profitability and cash flow are also impressive, making it a highly attractive investment opportunity.

Furthermore, Stripe’s strong revenue growth and profitability can be attributed to its unique business model, which focuses on recurring revenue streams. This recurring revenue model makes Stripe less susceptible to economic downturns and provides a stable foundation for future growth.

Regulatory Environment and Competition

The regulatory environment and competition in the payment processing industry can also impact the IPO price of Stripe. As a fintech company, Stripe operates in a highly regulated industry, and any changes in regulations can affect its operations and profitability. Moreover, the presence of strong competitors like PayPal, Visa, and Mastercard can limit Stripe’s market share and growth potential.

However, Stripe’s competitive advantage lies in its technology and customer-centric approach, which has enabled it to gain a significant market share in the global payments industry. By understanding the regulatory environment and competition, investors can better assess the potential risks and rewards associated with investing in Stripe.

Conclusion

In conclusion, predicting the IPO price of Stripe is a complex task that requires analyzing various factors, including market conditions, economic factors, financial performance, and competitive landscape. While it is challenging to provide an exact IPO price prediction, the analysis presented in this article offers valuable insights into the potential valuation of Stripe.

As the fintech industry continues to grow, Stripe’s unique business model and strong financial performance make it a promising investment opportunity. However, investors should be aware of the potential risks associated with the regulatory environment and competition in the payment processing industry.

In light of the analysis, it is reasonable to expect that Stripe’s IPO price could be in the range of $50 to $70 per share, considering its growth rate, profitability, and market potential. However, this is just an estimate, and the actual IPO price could vary based on market conditions and investor sentiment.

Moving forward, it would be beneficial to continue monitoring Stripe’s financial performance, market conditions, and regulatory changes to refine our predictions and make more informed investment decisions.